We often hear: «I rent on Airbnb, they collect the tourist tax, they send me a recap... so that's enough.’

In practice, Airbnb (and other platforms) can manage a part of the traveller experience, but not the legal existence of your furnished rental activity in France.

And above all: registering LMNP (Guichet unique → SIRET/SIREN) is not just a formality “for the administration”. It's also what gives you the hand, It protects you and saves you from a number of nasty surprises.

LMNP: it's not a “status”, it's a declarable activity

LMNP describes a furnished rental activity carried out on a non-professional basis. Since 1 January 2023, LMNP activity has required a online registration via the formalities desk and obtaining a SIRET number (in 15 days from the start of the rental period).

In practical terms: even if you only rent on Airbnb, registration doesn't just happen“.

What Airbnb does... and what Airbnb will never do for you

Airbnb can

- provide you with documents and summaries,

- apply certain platform-related rules,

- and, above all, to collect/transmit tax information under DAC7 (EU).

Airbnb cannot (and must not)

- declare the start of your LMNP business,

- choose your tax system (micro-BIC vs réel),

- managing your off-platform tax obligations“ (e.g. CFE, consistency of declarations),

- or secure your business if you also rent via Booking/Abritel/direct.

On impots.gouv.fr, the authorities are very clear: registration is used in particular to obtain a SIRET, publicise the existence of the business, and indicate the tax regime chosen.

The real advantages of having a SIREN/SIRET (and of doing it early)

1) You're square (and you sleep better)

The number one benefit is peace of mind: you declare your activity, you obtain your identifiers, and you take the steps required by the authorities (including the 15-day deadline).

2) You regain control over your tax situation (and often your profitability)

The “sinews of war” in LMNP is the tax choice and its implementation (micro-BIC vs réel, charges, depreciation, etc.).

Without your own registration, you are more likely to :

- choose the wrong frame,

- choose it too late,

- or find yourself having to “catch up” on items when you file your tax return.

And this rarely has a neutral effect on the result.

3) You put your case on a professional footing (bank, accountant, insurance companies, partners)

A SIRET is a simple “marker”: your business exists, it is identified, and your file becomes much easier to read when a third party asks you for information (accountant, bank, service provider, etc.).

4) You are no longer dependent on a platform

Today Airbnb, tomorrow :

- Booking,

- Abritel,

- your site,

- or direct bookings.

Your SIRET does not change your marketing strategy.

5) You are consistent with the reality of 2023+: platform transparency is increasing (DAC7)

DAC7 requires Airbnb to collect and transmit tax information on hosts receiving income via the platform. To put it plainly: “I'm not doing anything” makes less and less sense.

The (very real) disadvantages of not doing so

1) You put off doing something you have to do... and you often end up doing it in a hurry

The most common situation is that you wait until “later” and then have to regularise the situation at the wrong time (tax return, change of platform, request for supporting documents, etc.). But the obligation + the 15-day deadline exist.

2) You potentially lose money (wrong tax choice, wrong implementation)

The No. 1 risk is not the immediate fine: it's the loss of earnings (incorrect engine speed, non-optimised loads, framing errors).

3) You are exposing yourself to tax inconsistencies (CFE, returns, supporting documents)

Furnished lettings come with a number of obligations, including CFE (with exemptions in certain cases, notably where receipts are ≤ €5,000).

Airbnb doesn't manage this “for you”, and the day it drops, it becomes your subject.

4) Your “strategy” is based on a belief: “Airbnb = compliance”.”

Airbnb can do useful things, but the tax authorities point out that obtaining a SIRET and declaring that they are starting up their business.

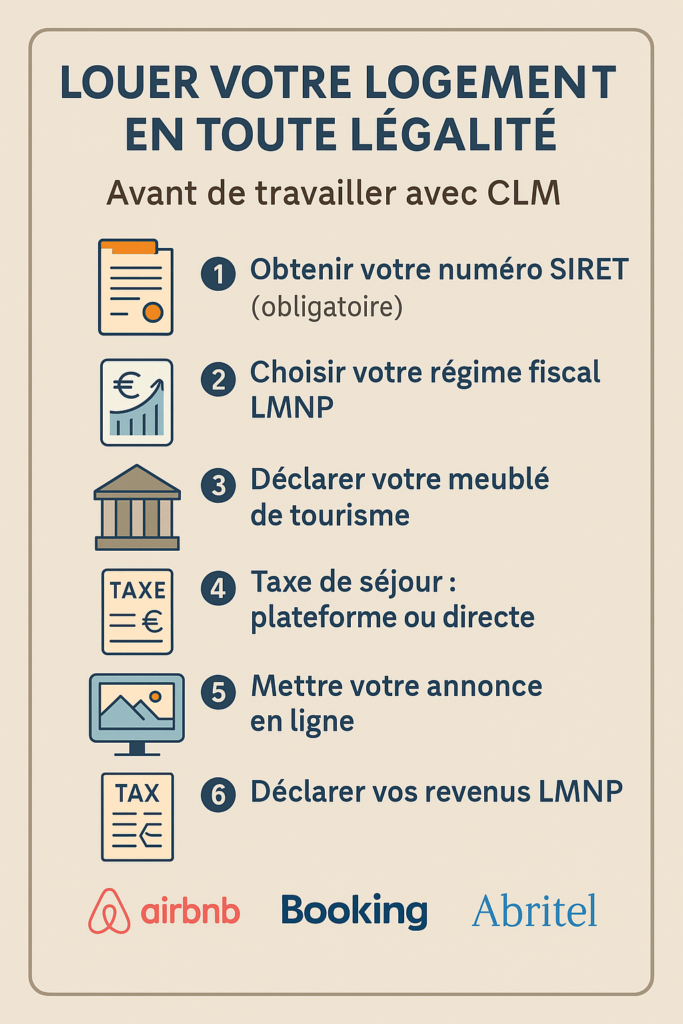

OK... and how do we do it?

For the practical part (the right choices to tick on the Guichet unique INPI, step by step), we have detailed everything here:

👉 Setting up your LMNP business on the Guichet unique (INPI): which options to choose, step by step

Conclusion

Registering as an LMNP is not about “pleasing the authorities”. It's about :

- comply,

- secure your income,

- keep control of your tax affairs,

- and not be dependent on a platform whose rules may change.