Short-term rentals on the Côte de Beauté - Royan, Meschers, Saint-Georges-de-Didonne, Vaux-sur-Mer... - can be very profitable.

But between :

- platform committee,

- caretaker costs,

- tourist tax,

- LMNP taxation (2026 reform),

...understand real NET income is not so simple.

Visit the clearest possible analysis, using a concrete example:

➡️ a stay billed at €1,000 to the traveller

1️⃣ €1,000 charged to travellers: what does this amount really contain?

The €1,000 quoted on Airbnb / Booking includes :

- the rent,

- tourist tax, which is automatically collected by the platform and paid to the local authority.

🎯 The tourist tax has a direct impact on your appeal

A little-known point:

✔ A furnished holiday home listed benefits from a reduced tourist tax.

This involves :

- a lower final price for the traveller,

- a better position in the Airbnb / Booking results,

- so more potential bookings.

Tourist tax is never income for the owner,

➡️ but lower tax increases your competitiveness.

2️⃣ Platform commission: approx. 15 %

Airbnb, Booking and Abritel charge an average commission of 15 %.

📌 Out of €1,000 :

- -150 € commission

- 850 € paid back to the owner

It is the first major reduction between the advertised price and your actual price.

3️⃣ Concierge fees: 20 % incl. VAT

A professional concierge service generally charges 18 to 25 % incl. VAT.

At CLM, our model is transparent: 20 % incl. VAT.

This fee includes :

- ad management,

- passenger communication,

- assistance during your stay,

- household coordination,

- complete calendar and price management.

📌 Out of €850 :

- -170 € INCL. VAT

- 680 € before LMNP tax

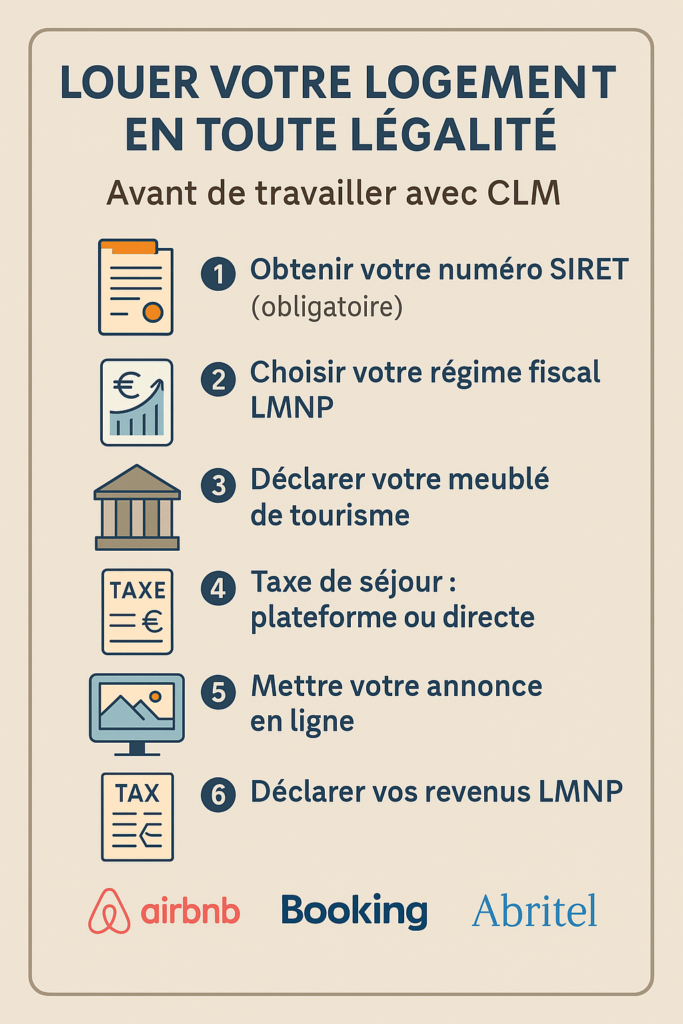

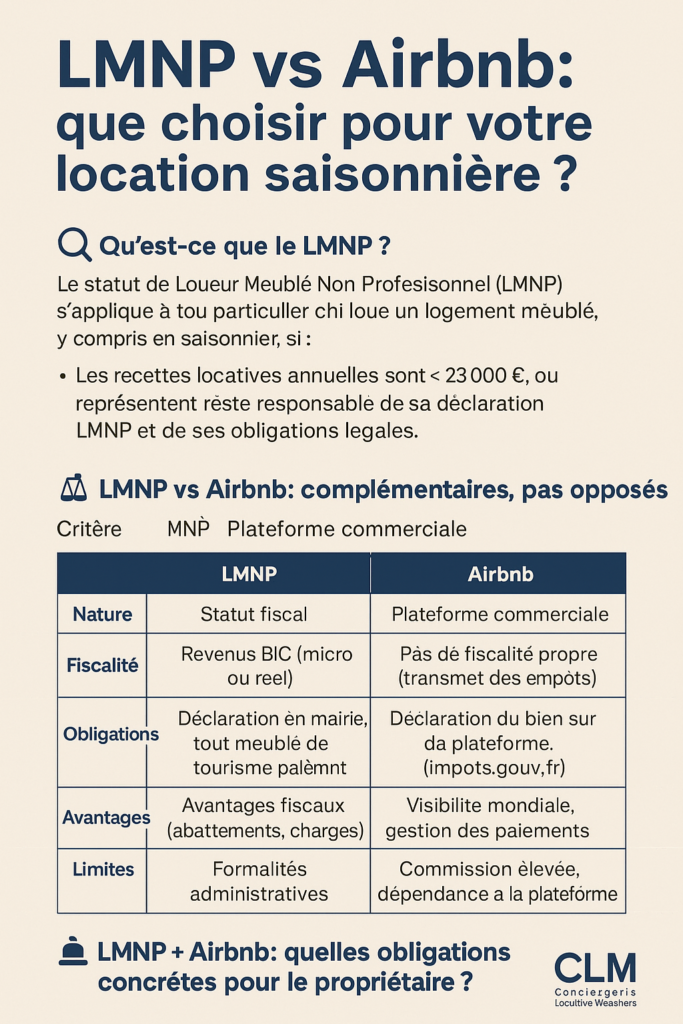

4️⃣ LMNP 2026 taxation: allowance of 30 % or 50 % (depending on classification)

Since the reform (2025 income declared in 2026), the rules are :

✔ NON-classified accommodation (unclassified furnished tourist accommodation)

- Micro-BIC allowance: 30 %

- Ceiling: €15,000

➡️ Beyond, compulsory actual scheme.

✔ Accommodation classified as furnished tourist accommodation

- Micro-BIC allowance: 50 %

- Ceiling: €77,700

🎯 Classification always allows for tax treatment much more favourable than 30 %.

Tax assumption used :

👉 Overall marginal rate for income tax + social security contributions = 30 %

5️⃣ Real-life example 2026: how much do you really have left over from €1,000?

After the platform and concierge service, revenue is identical in both cases :

➡️ 680 before tax

The difference comes from exclusively the LMNP tax system.

📊 Summary table 2026 - unclassified vs. classified accommodation

(Based on a stay of €1,000 paid by the traveller)

| Elements | Uncategorized | Classified as furnished tourist accommodation |

|---|---|---|

| Price paid by the passenger | 1 000 € | 1 000 € |

| Platform Committee (15 %) | -150 € | -150 € |

| Income after platform | 850 € | 850 € |

| Concierge service (20 % inc. VAT) | -170 € | -170 € |

| Income before tax | 680 € | 680 € |

| Micro-BIC tax allowance | 30 % | 50 % |

| Tax base | 476 € | 340 € |

| Taxes (30 %) | -143 € | -102 € |

| NET final proprietary | 537 € | 578 € |

| Net return on price paid | 53,7 % | 57,8 % |

🎯 Key facts

1) Classification improves both taxation and attractiveness

A classified home generates here +41 € net per stay.

Over the year, this can represent several thousand euros.

It also enables :

- a lower tourist tax,

- a lower final price,

- a better conversion rate.

2) Platforms take an average of 15 %

A cost that is often underestimated, but unavoidable.

3) Concierge service (20 % incl. VAT) makes everything easier

In a professional holiday let, it :

- maximises customer satisfaction,

- reduces your constraints,

- improves your occupancy rate.

4) LMNP tax depends heavily on classification

- 70 % of income is taxable unclassified (allowance 30 %)

- 50 % only classified

The difference is structural, and very significant.

🧠 Conclusion

Seasonal rental on the Côte de Beauté remains highly profitable in 2026...

provided that two major levers are optimised:

1️⃣ Classification of furnished tourist accommodation

✔ improve your attractiveness

✔ réduit votre taxe de séjour

✔ divise votre base imposable par deux

2️⃣ Une gestion professionnelle et optimisée

✔ maximise le revenu net

✔ simplifie l’exploitation

✔ sécurise l’expérience voyageurs

At CLM - Conciergerie Locative de Meschers, nous accompagnons les propriétaires sur :

- la fixation des prix,

- la fiscalité LMNP,

- l’obtention du classement,

- la gestion opérationnelle,

- le suivi des performances.

👉 Vous souhaitez connaître votre revenu NET exact pour votre logement ?

CLM réalise gratuitement une simulation personnalisée basé sur :

- votre logement,

- votre saisonnalité,

- votre stratégie tarifaire,

- votre situation fiscale.