- All

- Good plans

- Taxation

- Local News

- Laws

Fiche de police en location saisonnière (Airbnb, etc.) : obligation, responsabilités, et que faire si un voyageur refuse de signer ?

Obligation légale, responsabilités, et que faire si un voyageur refuse de signer – même s’il est déjà sur place Sur les groupes Facebook d’entraide entre conciergeries et hôtes Airbnb, le sujet revient sans cesse : “Personne ne la fait”,“C’est trop lourd”,“Il faut l’envoyer sous 48h sur une plateforme”,“Et si le voyageur refuse ?” Résultat : … Continue reading “Fiche de police en location saisonnière (Airbnb, etc.) : obligation, responsabilités, et que faire si un voyageur refuse de signer ?“

Why legally register your LMNP business (SIREN/SIRET) instead of “letting Airbnb manage it”?

We often hear, «I rent on Airbnb, they collect the tourist tax, they send me a recap... so that's enough.’

In practice, Airbnb (and other platforms) can manage part of the traveller experience, but not the legal existence of your furnished rental business in France.

Setting up your LMNP business on the Guichet unique (INPI): which options to choose, step by step

Would you like to declare your business as a non-professional furnished rental (LMNP) to obtain a SIRET (registration number) and be “in order” from a tax point of view? Since the introduction of the Guichet unique (one-stop shop), this can be done online via INPI (business formalities). The trickiest part isn't the paperwork... it's ticking the right options to avoid making mistakes (particularly the confusion between “micro-entrepreneur” and “micro-BIC”).

Concierge fees: when, how and why should they be deducted from tax?

Do you pay for concierge services (cleaning, check-in/out, traveller management)? Here's when and how to deduct your CLM concierge fees, depending on your tax regime (micro or actual) for furnished or unfurnished accommodation.

LMNP 2026: CFE & Council Tax (THRS)

With recent tax changes, many property owners are wondering whether they should pay the CFE (Cotisation Foncière des Entreprises), the THRS (Taxe d'habitation sur les résidences secondaires), or sometimes both.

What to do in the event of a major dispute during an Airbnb rental?

Over 95 % of Airbnb stays go off without a hitch.

But when a serious dispute arises - damage to property, dangerous behaviour, theft, squatting - it's essential to know what to do immediately, who can help, and how to prevent it happening again.

Seasonal lettings: what insurance do you really need to be well covered?

Renting out accommodation seasonally or on Airbnb very quickly raises an essential question 👉 “If a traveller damages something, who pays? And what does insurance really cover?”

Between the PNO, the traveller's home insurance, AirCover, Booking or the deposit, it's hard to find your way around.

Côte de Beauté tourist tax (2025): how does it work and what do you have to declare?

If you rent furnished accommodation on the Côte de Beauté, you are affected by the tourist tax. It may seem a complex subject, but once you know the rules applied by the Communauté d'Agglomération Royan Atlantique (CARA), everything becomes simple.

Which platform(s) should you choose to rent your property in 2026?

Between Airbnb, Booking, Abritel and direct bookings, the possibilities are numerous.

Each platform offers different services, with different benefits and costs.

And a concierge service can help you bring it all together.

The 2026 LMNP plan: why having your property classified will significantly increase your net income

Are you a LMNP holder or about to become one?

Are you looking for a simple way to pay less tourist tax AND less tax?

Holiday lettings: how much do you really have left once all the costs have been deducted (Version 2026)

Between platform commission, concierge fees, tourist tax and LMNP taxation, it's sometimes hard to understand what's really left in the owner's pocket.

I rent out my property on Airbnb for less than 120 days a year: do I need an LMNP SIRET?

Seasonal rental is attracting more and more property owners to Royan, Meschers and the Côte de Beauté. But one question keeps coming up: «If I rent out less than 120 days a year on Airbnb, do I still need a SIRET number?»

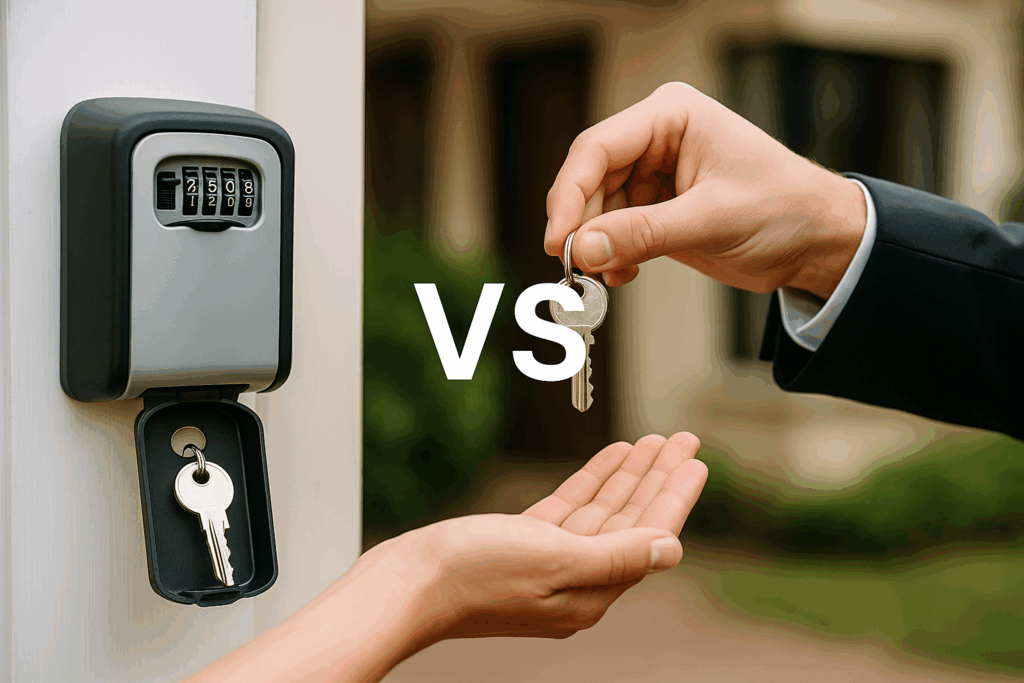

Key box or hand delivery? How do I choose a concierge service?

If you own a holiday rental property on the Côte de Beauté and are looking for a reliable concierge service to manage your arrivals and departures, one of the first questions to ask is whether you should opt for a key box or hand delivery.

The 2026 legal route: renting your accommodation on Airbnb, Booking or Abritel in full compliance

Do you want to rent out your accommodation on Airbnb, Booking or Abritel while remaining perfectly legal before working with CLM - Conciergerie Locative de Meschers?

Here is the simplest possible legal route, step by step, with all the useful links.

LMNP vs Airbnb: what should you choose for your holiday let?

Many property owners in Royan, Meschers and Saint-Georges-de-Didonne ask us the question: should I be a LMNP or use Airbnb?

In reality, it's not a matter of choice: LMNP is a tax status, while Airbnb is a commercial platform.

...

Carte G and rental concierge services: do the Hoguet Act apply to me?

Seasonal rental management is attracting more and more property owners to Royan, Meschers and the Côte de Beauté.

But one question often comes up: do you need a G card to manage a furnished rental property?

...

LMNP or para-hotel? The 4 services that make all the difference to your tax situation

Many property owners in Royan, Meschers and the Côte de Beauté opt for the LMNP (non-professional furnished rental) scheme for their seasonal lettings. But be careful: providing certain services can turn your business into a para-hotel, with much more onerous tax and social security obligations.

...

Anti-Airbnb law: what do property owners in Royan, Meschers and the Côte de Beauté need to know?

Holiday rentals are attracting more and more homeowners in Meschers-sur-Gironde, Talmont, Saint-Georges-de-Didonne, Royan, Vaux-sur-Mer and Saint-Palais-sur-Mer.

But faced with the rise of platforms such as Airbnb, new rules have been put in place: this is often referred to as the “anti-Airbnb law”.

...

Seasonal rental taxation 2026: LMNP, micro-BIC, allowances and charges explained simply (including useful links)

Holiday rentals are an excellent way to make the most of your property in Meschers-sur-Gironde, Royan and the Côte de Beauté.

But many homeowners have questions about taxation: which system should they choose? What charges should be deducted?

Is there any VAT to charge?

...